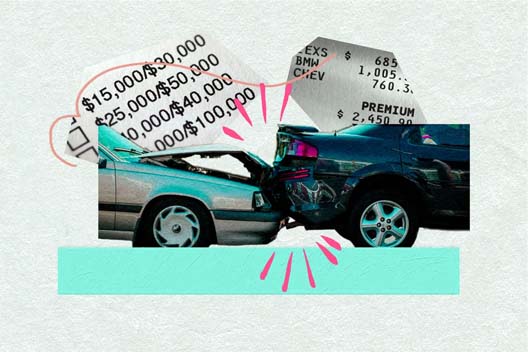

Car insurance helps pay for damage to your car and injuries from accidents. It also covers costs if you’re responsible for an accident. It also offers coverage against liability from accidents.

Car insurance is essential for every vehicle owner. It safeguards you from unexpected expenses due to accidents or damages. Policies vary, offering different coverage levels and premiums.

Choosing the right insurance can be confusing, but understanding your needs helps. Comprehensive coverage includes liability, collision, and personal injury protection.

Always compare quotes from multiple providers to find the best deal. Reading customer reviews can offer insights into a company’s reliability.

Remember, the cheapest option isn’t always the best. A good policy balances costs with adequate coverage. Regularly review and update your policy to ensure it meets your needs.

Why Car Insurance Rates Vary

Knowing why car insurance rates differ can help you make smart choices. Understanding various factors can save you money and help you find the right coverage, on which rates are based.

Factors Influencing Premium Costs

Several elements can affect your car insurance rates. These factors can be personal, vehicle-related, or even based on your location. Below are some key factors:

- Age: Younger drivers often pay higher premiums. Older drivers may get discounts.

- Driving Record: A clean driving record can lower your rates. Accidents and tickets can increase them.

- Vehicle Type: Luxury or sports cars usually cost more to insure. Safer cars may get lower premiums.

- Location: Urban areas often have higher rates. Rural areas usually have lower rates.

- Credit Score: A good credit score can reduce your premiums. Poor credit may increase them.

- Mileage: High mileage can lead to higher rates. Low mileage may offer discounts.

Myths Vs. Realities In Insurance Pricing

Many people believe myths about car insurance pricing. These myths can lead to misunderstandings and unexpected costs. Here are some common myths debunked:

Many people believe myths about car insurance pricing. These myths can lead to misunderstandings and unexpected costs. Here are some common myths debunked:

| Myth | Reality |

|---|---|

| Red cars cost more to insure. | Color has no impact on insurance rates. |

| Older cars are always cheaper to insure. | Sometimes, older cars cost more due to lack of parts. |

| Your job does not affect your rates. | Your job can influence your premiums. |

| All insurance companies offer the same rates. | Rates vary significantly between companies. |

Assessing Your Coverage Needs

Choosing the right car insurance can be confusing. It’s important to know what coverage you need. This guide helps you assess your coverage needs.

We’ll explore essential and optional coverage. We’ll also discuss evaluating risk and protection.

Essential Vs. Optional Coverage

Car insurance comes with many types of coverage. Knowing which ones are essential is key.

| Essential Coverage | Optional Coverage |

|---|---|

| Liability Coverage | Collision Coverage |

| Personal Injury Protection (PIP) | Comprehensive Coverage |

| Uninsured Motorist Coverage | Roadside Assistance |

Liability coverage is required by law in most states. It covers damages you cause to others. Personal Injury Protection (PIP) helps with medical expenses. Uninsured Motorist Coverage protects you if the other driver has no insurance.

Optional coverage can give extra protection. This includes collision and comprehensive coverage. These cover damages to your car.

Evaluating Risk And Protection

Think about your personal risk and protection needs. Everyone’s situation is different.

- Driving Habits: Do you drive long distances?

- Car’s Value: Is your car new or expensive?

- Location: Do you live in a busy city?

- Financial Situation: Can you afford high out-of-pocket costs?

If you drive a lot, consider more coverage. If your car is expensive, you may want full coverage. Living in a city may increase your risk of accidents. Your financial situation also affects your coverage needs.

The Impact Of Deductibles

Understanding the impact of deductibles on car insurance is crucial. Deductibles play a significant role in determining your insurance costs and coverage. They can affect your monthly premiums and out-of-pocket expenses during a claim. This section will explore how choosing the right deductible balances risks and savings.

Choosing The Right Deductible

Choosing the right deductible requires careful consideration. A deductible is the amount you pay before your insurance kicks in. For example, if you have a $500 deductible and your claim is $1,500, you pay $500, and your insurer pays $1,000.

Here are some factors to consider:

- Financial Situation: Can you afford a higher deductible in case of an accident?

- Driving Habits: Do you drive often or have a long commute?

- Vehicle Value: Is your car new or old? High deductibles may not be worth it for older cars.

Balancing Risk And Savings

Balancing risk and savings is essential in selecting deductibles. A lower deductible means higher monthly premiums. Conversely, a higher deductible lowers your premiums but increases your out-of-pocket costs during a claim.

Consider this table to understand the trade-offs:

| Deductible Amount | Monthly Premium | Out-of-Pocket Cost |

|---|---|---|

| $250 | $100 | Low |

| $500 | $80 | Medium |

| $1,000 | $60 | High |

Finding the right balance helps you save money while managing risk. Opt for a deductible that suits your financial capacity and driving habits. This way, you get the best value from your car insurance policy.

Discounts And Deals

Car insurance can be expensive, but there are many ways to save. Discounts and deals can help lower your premium. Knowing where to find these savings is key.

Commonly Overlooked Discounts

Many people miss out on easy savings. Here are some common discounts you might not know about:

- Good Driver Discounts: If you have a clean driving record, you can save big.

- Bundling Policies: Combine your car and home insurance for a discount.

- Low Mileage: If you drive less, your risk is lower. This often means a discount.

- Safe Vehicle Discounts: Cars with safety features may qualify for lower rates.

- Good Student Discounts: Students with good grades can get cheaper rates.

Negotiating For Better Rates

Don’t just accept the first rate you’re given. Negotiation can lead to better deals. Here are some tips:

- Shop Around: Compare quotes from different companies.

- Ask About Discounts: Always ask what discounts are available.

- Improve Your Credit Score: A better score can lead to lower rates.

- Increase Your Deductible: A higher deductible can lower your premium.

- Maintain a Clean Record: Avoid tickets and accidents.

Discounts and deals can make a big difference in your car insurance cost. Always look for savings and negotiate for the best rate.

Credit Score And Insurance Costs

Your credit score can greatly affect your car insurance costs. Insurers often check your credit score to determine your premium. Understanding how your credit score impacts your insurance rate can help you save money. Car insurance discounts help lower the cost of your insurance.

Understanding Credit-based Insurance Scores

Insurance companies use a special score called a credit-based insurance score. This score predicts how likely you are to file a claim. It’s different from your regular credit score but uses similar information.

Factors that affect your credit-based insurance score include:

- Payment history

- Outstanding debt

- Length of credit history

- Types of credit used

- New credit accounts

These factors help insurers decide your risk level. A higher score usually means lower insurance costs.

Improving Your Score For Lower Rates

Improving your credit score can lower your insurance rates. Here are some steps to improve your score:

- Pay bills on time: Late payments hurt your score.

- Reduce debt: Lowering your debt helps improve your score.

- Check your credit report: Ensure there are no errors.

- Limit new credit accounts: Too many new accounts can lower your score.

Improving your credit score takes time. Start with small steps and stay consistent. Better credit can lead to significant savings on car insurance.

Leveraging Technology For Savings

Car insurance can be expensive, but modern technology offers ways to reduce costs. Leveraging technology for savings is a smart approach.

Usage-based Insurance Programs

Usage-based insurance (UBI) programs use technology to track your driving habits. This can help you save money. These programs monitor your speed, distance, and braking habits.

Insurance companies use this data to tailor your premiums. Insurance companies reward safe drivers with lower rates. This is fairer than traditional methods.

Pay-as-you-drive (PAYD) is a popular UBI model. It charges you based on the miles you drive. This is great for people who drive less.

Another UBI model is pay-how-you-drive (PHYD). It focuses on your driving behavior. Safe habits mean lower premiums.

Apps And Devices That Lower Premiums

Many apps and devices can help reduce your car insurance premiums. These tools monitor your driving and encourage safe behavior.

Telematics devices are small gadgets you install in your car. They track speed, distance, and braking. This data helps insurers offer discounts.

Some insurers offer mobile apps that serve the same purpose. These apps track your driving through your phone. They provide feedback to improve your driving habits.

Many apps also offer gamification features. This makes safe driving fun and engaging. You can earn rewards and compete with friends.

Here is a table of popular apps and devices:

| App/Device | Features | Benefits |

|---|---|---|

| Drivewise | Tracks speed, braking, and time of day | Up to 15% discount |

| Snapshot | Monitors driving habits | Personalized rates |

| SmartRide | Tracks acceleration and cornering | Up to 40% discount |

Using these apps and devices can lead to significant savings. Plus, they promote safer driving habits.

Smart Shopping For Car Insurance

Smart shopping for car insurance can save you money and provide better coverage. Here are some tips to help you make informed decisions.

Comparing Insurance Providers

Comparing different insurance providers is important. This allows you to find the best deal. Use the following criteria to compare:

- Premium Costs: Check the monthly or yearly cost.

- Coverage Options: Evaluate what each policy covers.

- Deductibles: See how much you’ll pay out-of-pocket.

- Discounts: Look for available discounts like a safe driver or multi-car.

Here is a table to help you compare:

| Provider | Premium | Coverage | Deductible | Discounts |

|---|---|---|---|---|

| Provider A | $100/month | Full Coverage | $500 | Safe Driver, Multi-Car |

| Provider B | $120/month | Liability Only | $300 | Good Student |

| Provider C | $95/month | Full Coverage | $750 | Multi-Policy |

The Role Of Reviews And Ratings

Reading reviews and ratings is crucial. They provide insights into customer experiences. Look for reviews on:

- Customer Service: How well the company handles claims.

- Ease of ProcessBuying or renewing a policy is easy.

- Claims Satisfaction: How satisfied customers are with the claims process.

Here are some sources to find reviews:

- Online Review Sites: Websites like Yelp or Trustpilot.

- Social Media: Check comments and posts on Facebook or Twitter.

- Forums: Read discussions on car insurance forums.

Make sure to read both positive and negative reviews. This gives a balanced view of the insurance provider.

Maintaining Low Insurance Rates

Keeping your car insurance rates low is essential. It helps you save money. There are several ways to achieve this. Focus on driving safely and maintaining continuous coverage.

Driving Record And Premiums

Your driving record greatly impacts your insurance premiums. Safe driving habits can lead to lower rates. Avoid accidents and traffic violations to maintain a clean record.

Insurance companies reward drivers with no claims or violations. They see them as less risky. This could mean significant savings on your premiums.

| Violation | Impact on Premium |

|---|---|

| Speeding Ticket | Increases by 10-20% |

| DUI | Increases by 50-100% |

| Accident | Increases by 20-40% |

Increases by 20-40%

Continuous Coverage And Loyalty Benefits

Continuous coverage is another key factor. Avoid lapses in your insurance. Lapses can result in higher premiums. Insurance companies prefer consistent coverage.

Loyalty benefits can also help reduce your rates. Stay with the same insurer for several years. They often offer discounts for long-term customers.

- Safe driving leads to lower rates.

- Continuous coverage avoids high premiums.

- Loyalty benefits can save you money.

Follow these tips to keep your car insurance affordable. Your wallet will thank you!

Bundling Policies For More Savings

Car insurance can be expensive. One way to reduce costs is by bundling policies. Bundling means combining different types of insurance with the same company. This can lead to significant savings and added convenience.

Pros And Cons Of Bundling

Bundling policies has many benefits but also some drawbacks. Below is a detailed look at the pros and cons:

| Pros | Cons |

|---|---|

| Lower premiums | Limited options |

| Simplified billing | Potential for over-insurance |

| Better customer service | Possible penalties for switching |

Strategies For Multi-policy Discounts

To maximize multi-policy discounts, follow these strategies:

- Compare quotes from different providers.

- Ask about bundling during your initial inquiry.

- Review coverage to avoid over-insurance.

- Check for additional discounts like a safe driver or a good student.

By following these strategies, you can achieve significant savings. Always review your policies periodically to ensure you’re getting the best deal.

The Future Of Car Insurance

The future of car insurance is evolving rapidly. Emerging technologies and trends are reshaping the industry. Understanding these changes can help you stay ahead and make informed decisions.

Emerging Trends In Auto Insurance

Auto insurance is adapting to new realities. Usage-based insurance is gaining popularity. Here, your premium depends on your driving habits.

Telematics devices track your speed, braking, and mileage. Safe drivers can earn discounts.

Peer-to-peer insurance is another trend. It connects drivers to share risks. This model can lower costs and increase transparency.

On-demand insurance offers flexible coverage. You can activate it when you need it, ideal for infrequent drivers.

Electric and autonomous vehicles are also changing the landscape. Insurers are developing new policies for these advanced cars. They consider different risks and benefits compared to traditional vehicles.

How Tech Innovations Affect Rates

Technology plays a crucial role in determining insurance rates. Advanced Driver Assistance Systems (ADAS) reduce accident risks. Cars with ADAS features like lane-keeping assist and automatic braking often have lower premiums.

Artificial Intelligence (AI) helps insurers analyze data efficiently. AI can predict risks more accurately and personalize premiums. Blockchain technology ensures secure and transparent transactions. It reduces fraud and administrative costs.

Mobile apps and online platforms simplify the insurance process. They offer quick quotes, easy claims, and customer support. This convenience can lead to competitive pricing and better customer satisfaction.

| Tech Innovation | Impact on Rates |

|---|---|

| Telematics | Lower premiums for safe drivers |

| ADAS | Reduced accident risks, lower premiums |

| AI | Accurate risk assessment, personalized premiums |

| Blockchain | Reduced fraud, lower administrative costs |

The future of car insurance is exciting and full of opportunities. Stay informed and adapt to these changes to benefit the most.

Frequently Asked Questions

Who Typically Has The Cheapest Car Insurance?

Geico and State Farm often offer the cheapest car insurance. Rates vary by location, age, and driving history. Compare quotes to find the best deal.

What Is The Cheapest Insurance In Texas?

State Farm and Geico often offer the cheapest insurance in Texas. Rates vary based on individual factors. Compare quotes for the best deal.

Who Pays The Cheapest Car Insurance?

Young, single drivers often pay the highest car insurance rates. Older, married, and experienced drivers usually get cheaper insurance. Good credit scores and clean driving records also help lower costs. Shopping around and comparing quotes can also help find the most affordable options.

Which Insurance Is Best For A Car?

The best car insurance depends on your needs. Comprehensive coverage offers extensive protection, while liability is budget-friendly. Compare quotes from multiple insurers for the best deal.

What Is Car Insurance?

Car insurance is a contract between you and an insurer to protect against financial loss from accidents or theft.

Why Is Car Insurance Important?

Car insurance provides financial protection in case of accidents, theft, and damages, ensuring peace of mind and legal compliance.

How Does Car Insurance Work?

You pay premiums, and the insurer covers the costs of damages, injuries, or losses as per the policy terms.

Conclusion

Choosing the right car insurance can save you money and provide peace of mind. Compare policies, read reviews, and understand coverage options. Protect your vehicle and finances by making an informed decision. Remember, the best insurance policy balances cost and comprehensive protection for your needs.