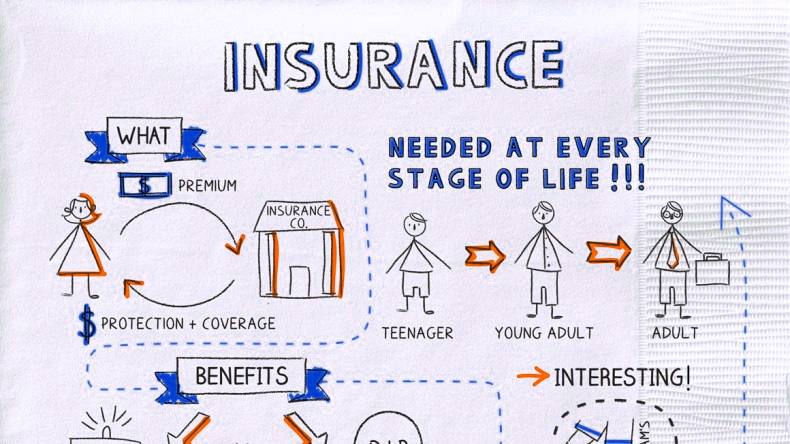

What is Insurance? Insurance is a contractual agreement offering financial protection against losses. It mitigates risks for individuals and businesses through policy coverage.

Understanding insurance is crucial for events in life and commerce.

This risk-sharing mechanism ensures that individuals or entities are not alone in facing financial setbacks. By resorting to insu-rance, people can safeguard their assets and obtain peace of mind.

Credit: www.facebook.com

What Happens When An Insurance Policy Is Backdated

Backdating an insurance policy can adjust the effective date to an earlier time, often to secure a premium based on a younger age. This retroactive feature might lead to immediate coverage but could also incur additional costs.

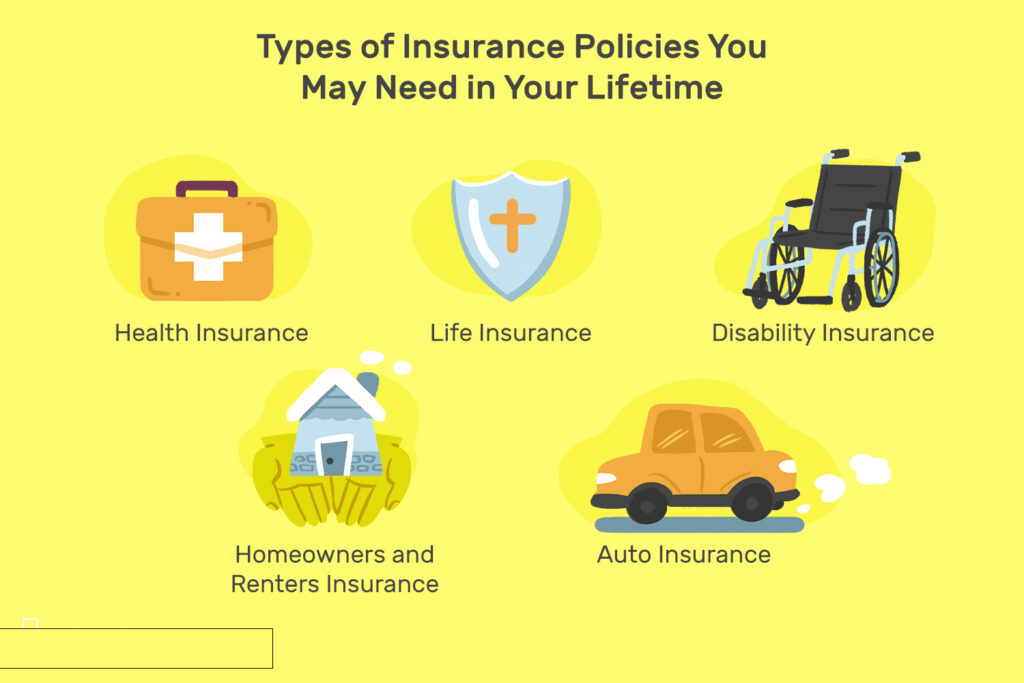

Insurance is an essential financial safety net that helps individuals manage risks associated with unforeseen events. Whether it’s safeguarding against damages to property or offering a lifeline in the event of health emergencies, insurance acts as a shield against economic turmoil.

But not all insu-rance policies are activated from the date you sign up. Sometimes, a policy can be backdated, leading to a few complexities and unique considerations.

Backdating a policy might sound like a concept pulled from a time-travel novel, but in the world of insurance, it’s a practical approach to specific needs. Typically, it means setting the start date of the policy to a time before the actual signing date.

This action can have several effects:

- Premium Payments:

The premium might be higher than if the policy started on the signing date due to the longer coverage period.

- Cover of Past Events:

If applicable, the policy could potentially cover claims for events occurring between the backdated start date and the signing date.

- Tax Implications:

Choosing a backdated effective date can sometimes lead to tax benefits depending on the type of policy and local regulations.

Reasons For Choosing A Backdated Insurance Policy

Opting for a backdated insurance policy isn’t a common practice, but there are specific scenarios where it makes sense:

- Locking in a Lower Premium:

Sometimes, policyholders might backdate to lock in a lower premium rate, especially if the insurance rates have increased recently.

- Age-Related Benefits:

In life insurance, age is a critical factor in determining premiums. Backdating to a date before a birthday can help in securing rates for a younger age.

- Policy Anniversary:

Backdating can be used to align the policy start date with another significant date, like a fiscal year start, for easier management.

Potential Drawbacks Of Backdating An Insurance Policy

While backdating can have advantages, it isn’t without its drawbacks. Let’s explore some of the potential negatives:

- Higher Out-of-Pocket Premium Costs:

You might end up paying premiums for a period when you weren’t actually covered, which could increase your immediate financial burden.

- Ethical Considerations:

Backdating to claim for an event that has already occurred can be fraudulent if it falls outside of the policy’s intended terms.

- Complex Legalities:

Each jurisdiction has specific laws regarding the backdating of insurance policies, making it a legal minefield if not navigated properly.

Navigating the complexities of backdated insurance policies requires a keen understanding of its implications on coverage, premiums, and legal standing. When considering the option, it’s imperative to weigh the potential benefits against the accompanying responsibilities and limitations. A transparent discussion with your insurance provider is essential to ensure that the policy serves its intended purpose while adhering to legal and ethical standards.

What Is Rebating In Insurance

Rebating in insurance refers to the unethical practice where insurers offer unauthorized inducements to attract potential policyholders. It is the act of providing discounts or returns from the agent’s commission to the customer, which can undermine market fairness and is often illegal.

Navigating the world of insu-rance can often feel like deciphering a cryptic puzzle, particularly when you encounter specialized terms like “rebating. ” It’s a concept that’s essential to understand, as it directly relates to the ethical and legal practices within the insurance industry.

What Is Rebating In Insurance?

Rebating in insu-rance is a practice that involves giving back a portion of the premium or agents’ commission to the insured as an incentive to purchase a policy. While this might seem like a beneficial arrangement for the consumer, it’s shrouded in controversy and strict regulations.

- Legal implications:

Rebating is illegal in many jurisdictions because it can create unfair competition and can be considered a form of bribery. The legality of rebating varies by state, with each state maintaining its own set of laws concerning the practice.

- Consumer perception:

Although receiving a rebate might appear advantageous for policyholders, it can raise questions about transparency and fairness in pricing models. Consumers should have access to consistent pricing without depending on potentially dubious rebating offers.

- Impact on the industry:

The prohibition of rebating helps to maintain the integrity of the insurance market, ensuring that all customers are treated equally and that the pricing of insurance policies is clear and straight forward. It promotes fair business practices and competition among insurer’s.

Why Rebating Is Frowned Upon

The insur-ance industry is built on trust and fairness, and rebating often breaches these core values. By offering rebates, an insurer may seem to imply that the initial cost of the policy was inflated, which can undermine consumer trust.

- Potential for biased advice:

Insur-ance agents might be tempted to recommend policies that provide them with higher commission, rather than those that are most suitable for the consumer, if part of that commission can be rebated.

- Disruption of market equality:

Rebating can lead to a skewed perception of value and quality in insu-rance products, as consumers may base their purchasing decisions on the rebate rather than the policy’s benefits and coverage.

- Thwarting comparability:

When rebates enter the equation, comparing insurance policies becomes more complicated for consumers, as they must consider the value of potential rebates in addition to coverage and cost.

Understanding rebating is crucial for anyone delving into insu-rance policies. By staying informed on what rebating entails and why it generally stands as a frowned-upon practice, you empower yourself to make more educated decisions in the insu-rance marketplace.

What Is Modified Whole Life Insurance

Modified whole life insurance is a type of permanent life policy that features a premium adjustment after an initial period. Policyholders enjoy lifetime coverage with the benefit of altered payments, tailored to their changing financial situations.

Navigating the complex landscape of life insurance can sometimes feel like trying to decipher a coded message. Among the different types out there, a particular kind—modified whole life insurance—often raises questions. What makes it unique, and could it be the right choice for your long-term financial planning?

Premium Structure Of Modified Whole Life Insurance

The payment plan for modified whole life insurance typically follows a set pattern:

- Initial period of lower premiums: This phase allows policyholders to enjoy coverage at reduced rates.

- Increment after a certain number of years: Once the initial period concludes, premiums rise to a higher rate and then level off for the duration of the policy.

Benefits Of Choosing Modified Whole Life Insurance

Selecting modified whole life insurance can be beneficial in certain situations:

- Entry-level affordability: The initial low premiums make it an accessible option for those with budget constraints.

- Guaranteed death benefit: Regardless of health changes, the benefit amount remains consistent, providing peace of mind.

Considerations Before Opting For Modified Whole Life Insu-rance

Making an informed decision is crucial when considering this insu-rance type:

- Preparing for premium increases: Policyholders must be ready for the scheduled upsurge in costs.

- Long-term budgeting: It’s important to evaluate whether future finances can accommodate the higher premiums.

Understanding modified whole life insurance and its distinctive characteristics helps clarify if it aligns with your financial goals. It’s one piece of the broader insurance puzzle, offering a balance between affordability and lifelong coverage for those who plan wisely for the premium changes ahead.

What Is Self Insured Retention

Self-insured retention refers to the portion of a claim that a policyholder agrees to pay out-of-pocket before an insura-nce policy provides coverage. It’s a predetermined amount set within an insurance agreement, emphasizing an organization’s willingness to assume a portion of the financial risk.

Navigating the diverse world of insurance can often feel akin to decoding a complex puzzle. Among the myriad terms and conditions lies the concept of self-insured retention, a crucial component for businesses and individuals who opt to shoulder a portion of their risk.

What Is Self-insured Retention?

Self-insured retention, or SIR, represents a specified sum of money that an insured entity agrees to pay out-of-pocket before their insurance coverage kicks in. It’s akin to a deductible, yet distinct in several key ways. With SIR:

- Risk management strategy: Entities accept a certain level of risk internally, encouraging proactive prevention measures.

- Cash flow control: By aligning the retention amount with affordability, organizations manage their cash flow effectively.

- Claims processing autonomy: Companies often have the latitude to handle claims within the SIR limit, giving them greater control.

Benefits Of Opting For Self-insured Retention

Choosing to incorporate a self-insured retention element into your insurance policy comes with a multitude of advantages. Delving into these benefits, you’ll understand why some entities favor this approach:

- Potential for cost savings: Over time, if claims remain low, the entity can save on premiums.

- Increased claims awareness: With SIR, organizations are more mindful and vigilant about potential claims.

- Customized risk management: Entities can tailor their risk management strategies to their unique setpoints and sensitivities.

Considerations Before Choosing Self-insured Retention

Deciding whether self-insured retention is appropriate for your circumstances requires thoughtful consideration. There are a few factors to contemplate:

- Financial stability: Ensure your business can absorb the costs associated with the SIR.

- Risk exposure: Review the potential risks thoroughly to decide on an adequate SIR level.

- Administrative capabilities: You should be equipped to handle claims administration within the SIR limit.

By weighing these components carefully, businesses can make informed decisions about self-insured retention and its role within their broader risk management framework. The goal is to strike a balance between potential savings and the ability to mitigate risks effectively. After all, the realm of insurance is all about safeguarding assets while maintaining financial prudence.

What Is A Self Insured Retention

Self-insured retention is a policy feature where the insured assumes financial responsibility for a predetermined amount of loss before insurance coverage kicks in. It’s a risk management strategy, essentially acting as a deductible in commercial liability policies, enabling companies to lower premiums while maintaining control over minor claims.

Let’s delve into what this means for businesses and individuals alike.

What Is Self-insured Retention?

Self-insured retention (SIR) is a policy feature found in liability insurance policies. It is the amount of money that the insured must pay out of pocket before the insurance company’s coverage begins to apply. Imagine it as a threshold that the policyholder is responsible for reaching before the safety net of the insu-rance kicks in.

Unlike a deductible, which is typically paid per claim, SIR involves the insured covering all incurred losses up to a certain amount.

How Does Self-insured Retention Work?

Let’s break down the process of self-insured retention to clarify how it operates:

- Risk Assessment: The insured evaluates potential risks and decides the level of SIR they’re comfortable with, balancing financial capacity with risk exposure.

- Financial Responsibility: Up to the agreed SIR amount, the pays all claim costs directly. This includes any legal fees, settlements, or other costs associated with a claim.

- Insu-rance Coverage Activation: Once the SIR limit is exceeded, the insurance company takes over payment of additional costs, up to the policy limits.

- Impact on Premiums: Often, opting for higher SIR can lead to lower insurance premiums, as the assumes more responsibility for initial losses.

Benefits Of Self-insured Retention

Choosing a self-insured retention plan comes with its own set of advantages:

- Control: Policyholders gain more control over claim management. This can lead to swifter claim resolution and potentially better outcomes.

- Cash Flow: It allows for better cash flow management as claims under the SIR limit are handled internally without involving the insu-rance carrier.

- Savings: By handling smaller claims themselves, businesses can save on premiums since they are taking on more upfront risk.

The decision to opt for a self-insured retention plan isn’t one to be taken lightly. It hinges on a strategic risk assessment and thorough consideration of a company’s financial health and tolerance for risk. When chosen wisely, an SIR can be a powerful tool in a comprehensive risk management strategy, offering both cost savings and greater control over the claims process.

FAQ

What Is The Simple Definition Of Insurance?

Insurance is a contract providing financial protection against potential future losses or damages in exchange for premium payments.

What Is Insu-rance And Why Is It Important?

Insu-rance is a financial safety net that protects against unexpected losses. It’s crucial as it offers peace of mind by minimizing financial risks from events such as accidents, natural disasters, or illnesses.

What Does Insurance Work?

Insurance provides financial protection by pooling risks among policyholders. You pay premiums, and the covers unexpected losses as defined in your policy.

What Is The Definition Of Insu-rance In Short Term?

Insu-rance is a contract where an individual or entity receives financial protection against losses from an exchange for premiums paid.

What Is Insurance?

Insurance is a contract where an individual or entity receives financial protection or reimbursement against losses from company.

Conclusion

Understanding insurance is crucial for safeguarding our assets and ensuring peace of mind. It acts as a safety net, mitigating financial risks from unforeseen incidents. We encourage all to consider the right policy to secure their future. Embrace the protection it offers; let it empower your financial planning.